Staying Safe While Transacting in the Festive Season

Share:

As festive activity picks up, the message remains simple: stay alert

With increasing festive activities, personal awareness and smart transacting habits are becoming more important than ever. With more people shopping, traveling, and transacting, experts say a few simple precautions can go a long way in keeping finances secure and stress-free.

Go Cash-Lite for Convenience and Safety

Carrying less cash is increasingly seen as both a safety and convenience choice. Digital payment options now allow people to pay for daily purchases, settle bills, and send money to friends or family quickly and securely. Mobile banking apps such as the Equity Mobile App and card payments reduce the need to move around with large amounts of cash, making transactions easier and safer, especially in busy urban areas.

Take Control of Your Finances, Anytime

Mobile and online banking platforms have also made it possible for customers to manage their finances wherever they are. From paying bills and transferring funds to checking balances, these tools offer flexibility and control without the need to queue at banking halls or ATMs. For many users, this convenience translates into fewer physical transactions and lower exposure to risk.

Always Verify Before You Transact

Whether sending money digitally or responding to a call or message, verification remains critical. Fraud awareness specialists caution against acting on unsolicited phone calls claiming to be from banks. Financial institutions do not ask customers to transact over the phone or to share sensitive information such as card details, CVV numbers, PINs, or one-time passwords (OTPs). Any request for such details should raise immediate red flags. Using strong, unique passwords for banking apps and online accounts also adds an extra layer of protection against fraud.

Similarly, people are encouraged to think twice before clicking on links received via SMS or email. Suspicious websites and fake loan offers are common tactics used by fraudsters, particularly during busy seasons when people are more distracted.

Protect Your Card and Act Quickly

Card security is another key aspect of safe transacting. Customers are advised never to share their CVV or OTP and to only transact on verified, trusted websites. In the event that a card, phone, or SIM line is lost, taking immediate action to block access can help prevent unauthorized transactions and financial loss.

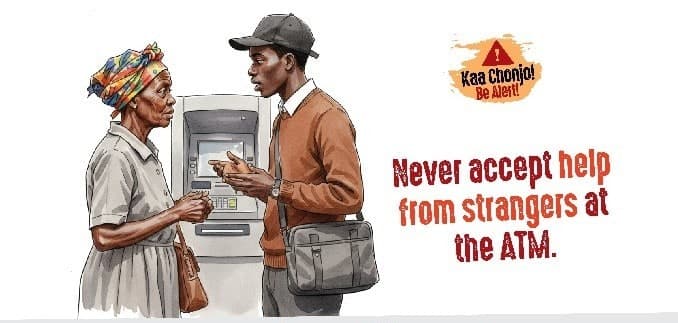

Stay Alert at ATMs

For those who need to withdraw cash, staying alert at the ATM is especially important during peak periods. Users are encouraged to shield their PINs while entering them, remain aware of their surroundings, and avoid distractions. A quick check of who’s nearby before and after a transaction can help reduce risk.

As festive activity picks up, the message remains simple: stay alert, use available digital tools wisely, and take a moment to think before every transaction. Small, mindful actions can make all the difference in ensuring a secure and convenient banking experience during the holiday season and beyond.

If you are an Equity customer, you are encouraged to #KaaChonjo, stay alert to fraud by hanging up on suspicious calls, always confirm that calls are from 0763 000 000, avoid clicking unknown links, and report or block your account immediately if your card, phone, or line is lost.

Tags

#equity mobile app

Share: